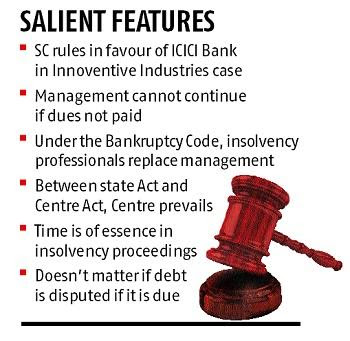

Whether

State Law can supersede the Insolvency Proceedings under Insolvency &

Bankruptcy Code, 2016? No, says Supreme Court.

ICICI BANK

VS

INNOVENTIVE INDUSTRIES

FACTS

This

is the first case filed in December 2016 in Mumbai under the Insolvency and

Bankruptcy Code. Innoventive Industries approached the Supreme Court for the

relief against the order of NCLAT & Bombay High Court.

In

this case, Supreme Court has ruled the management of a company

undergoing bankruptcy proceedings cannot run the company’s

management.

Supreme Court was of the

opinion that entrenched managements are no longer permitted to remain in management

if they unable to pay their debts.

This

bolsters the Insolvency and Bankruptcy Code, which says once an insolvency

professional is appointed by creditors, the management should step aside and

let the company be run by the professional.

The

insolvency professional, in turn, will decide if the company must go in for

liquidation after six months.

The

ICICI bank had sued Pune-based Innoventive Industries over non-payment of dues.

The steelmaker owes banks over Rs 950 crore.

After

the NCLT ruled in favour of ICICI Bank, Innoventive

Industries moved the Bombay High Court and the appellate tribunal, challenging

the validity of the Insolvency and Bankruptcy Code and demanding borrowers be

heard before creditors during insolvency proceedings.

The

appellate tribunal upheld the NCLT verdict. In February, the Bombay High Court disposed

of the writ petition by the company.

ISSUE

Supreme

Court discussed about the concept of default under the Insolvency and

Bankruptcy Code and how it must be ascertained; what was the scope and

extent of enquiry at the admission of an insolvency application; and what was

the scope of hearing to be provided to a corporate debtor.

The

Supreme Court also scrutinised whether protection granted under the Maharashtra

Relief Undertaking Act rendered an application under the Insolvency and

Bankruptcy Code not maintainable.

DECISION

Innoventive

Industries had appealed that it could not be called a defaulter because the

Maharashtra government had notified a suspension of its dues for a period of

one year up to July 2017. The Supreme Court ruled in matters of contention between state laws and those of the Centre’s, the latter should

prevail.

Supreme

Court was of the opinion that time was of essence in insolvency proceedings, admission

of default should be made by the authorities within 14 days of the receipt of

the application. In case a debtor has defaulted, the adjudicating authority has

to merely see the evidence produced by the creditor to satisfy itself that

there was indeed a default.

Courtesy -Business Standard

No comments:

Post a Comment