Debts which were

otherwise not recoverable due to being time barred nature now can be basis for

initiating insolvency proceedings, says NCLAT.

Neelkanth Township &

Construction Pvt. Ltd.

Vs

Urban Infrastructure

Trustees Ltd.

FACTS

Neelkanth Township & Construction Pvt. Ltd, the corporate

debtor appealed against the order of the National Company Law Tribunal (“NCLT”)

allowing commencement of insolvency proceedings on the action of the financial

creditor (Urban Infrastructure Trustees Ltd.).

The financial creditor had subscribed to optionally

convertible debentures (“OCDs”) issued by the corporate debtor. OCDs carried

nil or 1% p.a. interest rate and matured in years 2011, 2012 and 2013.

Neelkanth Township & Construction Pvt. Ltd, the corporate

debtor argued that given that the debentures matured in years

2011, 2012 and 2013, the petition for initiation of corporate insolvency

resolution process filed in year 2017 is time barred.

·

The application of the financial creditor

before NCLT was not complete as it did not contain document prescribed under

Section 7(3)(a) of the IBC;

·

Section 7(3)(a) provides:

·

“(3) The financial creditor shall, along with

the application furnish—(a) record of the default recorded with the information

utility or such other record or evidence of default as may be specified;”

·

The financial creditor is actually an investor

and not a ‘Financial Creditor’ as defined under the IBC.

VERDICT

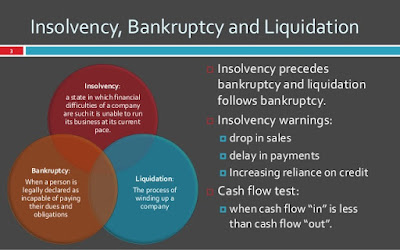

APPLICABILITY OF LIMITATION ACT, 1963

NCLAT

viewed that that in the absence of any provision in IBC, the Limitation Act,

1963 would not be applicable to initiation of Corporate Insolvency Resolution

Process.

It

viewed further that

“If there is a debt which includes interest

and there is default of debt and having continuous course of action, the

argument that the claim of money by Respondent is barred by Limitation cannot

be accepted.”

PROCEDURAL REQUIREMENT COULD NOT FRUSTRATE

The Insolvency & Bankruptcy Board of India (“Board”) has

not specified any other record or evidence of default which may be furnished.

Further, as there was no record of default recorded with the information

utility, it was contended that the application filed was incomplete. However,

the NCLAT rejected the argument, holding that a procedural requirement could

not frustrate the substantive provision of law.

INSOLVENCY & BANKRUPTCY (APPLICATION TO ADJUDICATING

AUTHORITY) RULES, 2016

The NCLAT also referred to the Rule 41 of the Insolvency

& Bankruptcy (Application to Adjudicating Authority) Rules, 2016 whereby a

financial creditor is required to make an application in accordance with

prescribed form – 1.

FORM 1 WILL BE SUFFICIENT EVIDENCE OF DEBT UNDER SECTION 7 OF

THE IBC.

Part V of the said form prescribes the particulars that need

to be provided as part of the application. The NCLAT ruled that in absence any

regulation framed by the Board, the evidence of default, records and documents

prescribed under Part V of the Form – 1 will be sufficient to determine default

of debt under Section 7 of the IBC.

REGULATION 8 OF INSOLVENCY AND BANKRUPTCY BOARD OF INDIA

(INSOLVENCY RESOLUTION PROCESS FOR CORPORATE PERSONS) REGULATIONS, 2016

Regulation 8 of Insolvency and Bankruptcy Board of India

(Insolvency Resolution Process for Corporate Persons) Regulations, 2016 was

also relied upon to substantiate the documents and records the financial

creditor could rely upon to prove a claim.

MEANING OF FINANCIAL CREDITOR:

As a financial creditor is one to whom a

financial debt is owed, issue arose regarding meaning of financial debt.

Financial debt is defined under Section 5(8) of IBC as:

“(8) “Financial debt” means a debt along with

interest, if any, which is disbursed against the consideration for the time

value of money and includes—

SECTION 5(8) (C) OF IBC CODE 2016

NCLAT held that section 5 (8) (c) makes it

clear that a debenture comes within the meaning of financial debt. Thus, in the

present case, the amounts owed on maturity of debentures would be a financial

debt.

I think and believe and of the opinion that there should not be Limitation Act for any appeals. It had been Rightly said by Hon. Justice Mr M P Thakkar in a case Collector Land Acquisition V Mst Khatija Bibi >>> where in stated that the delay may be condoned and Party May be heard Judicially and decide the matter on merits. Not straight a way dismissal which happens.

ReplyDelete