How to Attain Competitive advantage Through Innovation

WHAT IS AN INNOVATION?

Innovation is a new idea or notion that result

in a new service or product. Innovation can make a great impact on the

purchase, usage and disposition styles.

- For

instance, Microwave ovens have transformed the manner we cook.

- Text

messaging and email has transformed the manner we interact.

- Digital

cameras and mobile phones have transformed the manner in which we take photos

and exchange them with our friends.

- Reusable and recyclable packaging have

transformed the awareness on recycling the products.

- For

disposing of the scraps or unwanted products or used products, now on-line sites

such as Craigslist, eBay and Freecycle offer innovative means for consumers.

“Why innovation is seen

as a core competency in relation to competitive advantage and how this relates

to the current highly competitive state of the global event industry?”

The main

aim of each business organisation in today’s highly competitive atmosphere is

to overthrow competition by winning new customers. Those businesses which are

owners of knowledge symbolise a tool for the creation of innovations. As per

Hana (2013), nowadays business organisations find it significant to innovate

and encourage an innovative culture.

According to him, knowledge too is very critical in the process of

innovation since it symbolises not only significant but also the output of the

alteration progression. According to Bartes (2009), the 21st century is footed

upon information, knowledge and state-of-the-art economy.

Today, if an organisation wants to be a

success, it has to rely on knowledge of the employees, their creative function

and with more relevance is imposed on uninterrupted learning and research and

development. Tushman & Nadler (1986) pointed out that business

organisations can reap competitive benefit only by managing the business

effectively today while concurrently fostering creative for tomorrow. (Tushman

& Nadler 1986:74). Thus, for any business, innovation is still visualised

as a major driver for economic performance. As per Tidd et al., (2006),

business owners who tries to employ technological innovation for manufacturing

a new or novel product or service or by using a new process in the course of

their manufacturing process, definitely will attain a strategic competitive

benefit as compared to its competitors (Hana 2013:82).

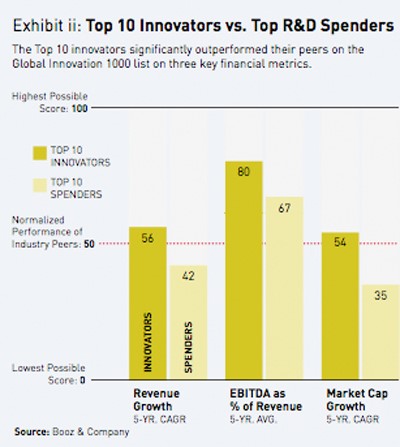

As per

Global Innovation 1000 study (2011), 7 of the top 10 innovating companies were

not actually top spenders of innovation. However, these top 10 innovators are

able to maintain a good financial performance than the top 10 R&D spenders

(Jaruzelski & Mainardi 2011).

The

following table demonstrates how the top 10 most innovative companies like

Google, Apple, 3M, Toyota, GE, P&G, Microsoft, Intel and Samsung are expending.

INNOVATION HELPS TO INCREASE THE NETWORTH

The

following figure shows how the top 10 innovating companies noteworth

outstripped their peers on the Global Innovation 1000 list on the major three

major financial metrics such as revenue growth, market cap growth and the

EBITDA as % of revenue. Thus, innovative

companies are able to expand their growth in revenues, market cap growth and an

increase in EBITDA .

“The four key dimensions

of innovation: Product, Process, Position and Paradigm offering events industry

examples of each.”

At the

phase of product development, a capability to involve actively with the

consumers to demonstrate the soundness of the concepts and to evaluate market perspective

and risks and the capability to clout the present product podiums into new

products .

Xerox Innovation

PROCESS DEVELOPMENT

Process

development stage takes many phases. For instance, Xerox introduced the first

ever copying machine in 1949 which had to be operated by the experienced

operators manually. Xerox later resorted to processing enhancement and market

switching by introducing lithographic plate printing. In 1955, Xerox introduced an automatic

version of its copier, and in 1958, it introduced advanced copier machines with

after sales services. Thus, for Xerox, it took nearly one decade to improve its

process

POSITIONING

Positioning

involves placing the invented process or product in a particular context. It

refers to how a particular process or product is comprehended symbolically and

how they are employed. For instance, Levi-Strauss jeans are a well-known

international product which originally produced as clothing material for manual

workers then re-branded as a fashion item (elrha.org 2015).

Paradigm innovation

Paradigm

innovation refers to the whole sector paradigm-footed innovations which relate to the

mental replicas which outline what a business is about. The emergence of

community –oriented feeding therapy to eliminate malnutrition is the recent

illustration of paradigm shift of innovation as it involves a mixture of a

product which is PlumpyNut, a distribution for the whole community (the

process), the absence of the role of aid agencies (a paradigm shift) and

involving communities to offer a solution to handle the malnutrition at home

itself (elrha.org 2015).

At

commercialisation phase, a capability to function with the pilot users to phase

out the products more methodologically and to coordinate across the whole

organisation for an efficient launch (elrha.org 2015).

“The Consequences for

not innovating.”

As per

Joseph Schumpeter, the business failures are triggered by incidents which are

external to the business. There are many business failures mainly due to

constant soaring in the market competition which is triggered by innovation.

There will be creative destruction if a business fail to innovate and to swim

along with its competitors. Some of the businesses that failed

not to invent are Xerox, Yahoo, Blackberry, MySpace, Polaroid and the whole

publishing industry

Innovation

is like oxygen for any organisation whether it is a small or big one. Business

organisations which do not innovate may lose their position in the market. Many

companies who do not innovate had disappeared from the market, and the examples

are Xerox, Yahoo, Blackberry, MySpace, Polaroid and the whole

publishing industry. There are many advantages for the firms that innovate. As per Global

Innovation 1000 study (2011), 7 of the top 10 innovating companies were not actually

top spenders of innovation. However, these top 10 innovators are able to

maintain a good financial performance than the top 10 R&D spenders

(Jaruzelski & Mainardi 2011). This demonstrates that if a business

organisation wants to grow both vertically and horizontally, it has to innovate

and this is needed for their survival and to outperform their competitors.