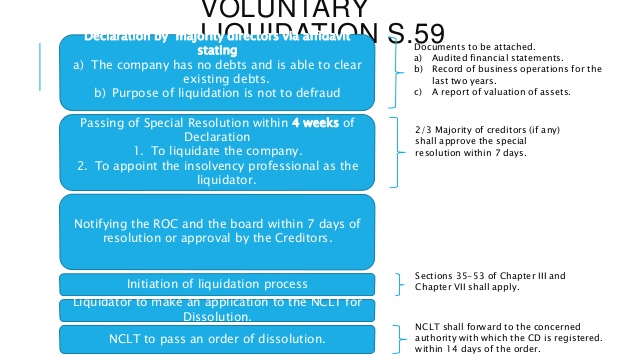

STEP BY STEP PROCEDURE

FOR VOLUNTARY LIQUIDATIONS UNDER INSOLVENCY & BANKRUPTCY CODE, 2016

Voluntary Liquidations

IBBI notified on 31st March, 2017 the IBBI (Voluntary Liquidation Process)

Regulations, 2017 to enable a corporate to liquidate itself voluntarily if it

has no debt or if it will be able to pay its debts in full from the proceeds of

the assets to be sold under the liquidation.

In pursuance to these Regulations,

ten corporates had initiated voluntary liquidation proceedings by 30th June,

2017. During this quarter

July- September 2017, 32 corporates initiated such proceedings.

It is the easy way of closure of company under IBBI

regulations. The following conditions have to be satisfied.

1.

There should be no debts

2.

Or It will be able to pay its debts in

full from the proceeds of the assets to be sold under the

liquidation.

1

|

CONVENEING

OF BOARD MEETING FOR VOLUNTARY WINDING-UP

a) To convene a

board meeting to approve the voluntary liquidation.

b) To call for a

general meeting to get the approval of members for the voluntary winding up.

c) In the same meeting,

pass a board resolution for the appointment of liquidator and fix his remuneration.

d) Pass a resolution to empower the liquidator

to operate the bank account.

|

2

|

DECLARATION OF SOLVENCY AND VALUATION

CERTIFICATE

At

the Board Meeting, Declaration of solvency duly verified by an affidavit is

to be given by the majority of directors/ designated partners, as the case

may be.

*

Audited financial statements and record of business operations of the

/corporate for the last two years or for the period since its incorporation,

whichever is later;

* a report of the valuation of the assets of the corporate, if any, duly certified by a registered valuer; |

3

|

FILING WITH THE ROC

To

file the declaration of solvency along with audited accounts, report of the

auditors with the Registrar of Companies within one month immediately preceding

the date of passing Special Resolution in the general meeting.

|

4.

|

NO

OBJECTION CERTIFICATE FROM CREDITORS

If the Corporate owes any debt to any one:

To obtain No Objection Certificate ( NOC) from the creditors signifying 66% of the value of debt of the Corporate or pass special resolution at a duly convened creditors meeting, within 7 days from the date of passing of Special Resolution at the general meeting. |

5

|

PUBLIC ANNOUNCEMENT IN FORM

A –SCHEDULE 1

A

public announcement is to be made by liquidator in Form A of Schedule I

within five days of his appointment inviting stakeholders to submit their

claims due to the Corporate within one month from the date of application.

|

6

|

INTIMATION TO ROC &

IBBI

To

intimate the special resolution passed by the Corporate to the Registrar and

to the IBBI within one week of passing of Special Resolution.

|

7

|

A SEPARATE BANK ACCOUNT FOR

VOLUNTARY LIQUIDATION

A

separate bank account to be opened by the Liquidator in the name of the

corporate with the word “in voluntary liquidation” in a scheduled bank, for

receiving all moneys due to the corporate person and to meet all the

liquidation cost.

|

8

|

TO FIX DEADLINE FOR

RECEIVING STATEMENT OF CLAIM

Form B -Operational

Creditors to submit their claim

Form C- Financial Creditors to submit their claims Form D- Workmen and Employees to submit their claim

Form E –where there

are large number of employees claims

to be submitted

Form F- For All Other Stakeholders or Claimants |

9

|

PRELIMINARY REPORT BY

LIQUIDATOR

The

Preliminary report which is to be prepared by Liquidator should have the

following

a)

The Capital arrangement of the Corporate;

b) the evaluations of its assets and liabilities as on liquidation start date based on the books of the Corporate. C) whether the liquidator wants to inquire into any further inquiry into any matter relating to the Corporate or to the conduct of the business thereof; d) projected plan of action for carrying out by the liquidation (including the timeline within which he recommends to complete the procedure and the projected liquidation cost. |

10

|

LIST OF CLAIMS

Liquidator

shall draw a list of claimants on the footing of the evidence of claims

submitted and accepted with the following columns as may be applicable:

i) Extent of claim acknowledged; ii) the amount of dues to which the debts dues are secured or unsecured; iii) the particulars of claimants; iv) evidence acknowledged or disallowed in part or proof rejected fully within one-and-half month from the last date of receipt of claim |

11

|

DISBURSEMENT OF REALISED

VALUE

Liquidator

has to realise all the assets of the corporate and shall subtract the cost of

liquidation from the amount so realised and after subtracting the liquidation

cost, shall allocate the realised amount among the claimants, within 180 days

of receipt of the receipt of claim from the stakeholders

|

12

|

DEADLINE FOR COMPLETION OF

VOLUNTARY LIQUIDATION

Liquidator

to complete the liquidation process within one year from the date of start of

liquidation process.

|

ANNUAL STATUS REPORT

In case

the liquidation process prolongs s for more than 12 months :

the liquidator shall

a.

should call a meeting of the contributories of the corporate person within 15

days from the close of the year in which he is nominated, and at the end of

each succeeding year; and

b. present an Annual Status Report(s) indicating progress in liquidation including- (i) A list of settlement of claimants, (ii) particulars of any assets that leftovers to be sold and realized, (iii) financial settlement made to the stakeholders, and (iv) The details of distribution of unrealised assets made to the claimants; (v) Is there any material litigation, by or against the corporate ; and (vi) Filing of, and developments in applications for avoidance of transactions in accordance with Chapter III of Part II of the Code. Annual Status Report shall enclose the audited accounts of the liquidation |

|

13

|

FINAL LIQUIDATION REPORT TO

REGISTRAR AND IBBI

Liquidator

to submit final report to the IBBI and to the Registrar

|

14

|

APPLICATION TO NCLT FOR

WINDING-UP

Liquidator

shall make application to the NCLT for dissolution of Corporate.

|

15

|

DISSOLUTION ORDER BY NCLT

On

receipt of the application, NCLT shall pass an order that the corporate shall

be dissolved from the date of NCLT order.

|

16

|

FILING WITH THE REGISTRAR

OF COMPANIES

Within

2 weeks of the NCLT dissolution order,

copy of order shall be forwarded to concerned Registrar of Companies

|

GOOD ONE. THANKS FOR SHARING FOR THE BENEFIT OF OUR PROFESSIONALS

ReplyDeleteCan I know the name of 32 CO who opt for same, article is nice

ReplyDeleteThanks Mr P K Murthy for your positive feedback.

ReplyDeleteThanks Mr Manish for your positive feedback. I will revert to you shortly

ReplyDeleteNice written . It is crispy and simple to grasp.

ReplyDeleteThanks a lot Mr Jitendra Dash for your comments

ReplyDeleteVery useful update of the IBc 2016, It is useful of exam as well as practical aspect. Hateoof to Sri R.V.Sekar for his continuos posting on Insolvency and Bankrupatcy resolution process

ReplyDeleteThanks Rasi

ReplyDelete