THE ROLE OF COMMITTEE OF CREDITORS (COC) IN (CIRP) CORPORATE INSOLVENCY RESOLUTION PROCESS UNDER THE INSOLVENCY AND BANKRUPTCY

CODE, 2016

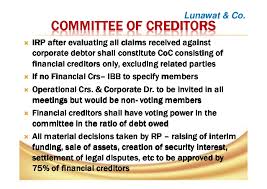

COMMITTEE OF CREDITORS (COC)

The Insolvency and Bankruptcy Code, 2016 (Code), however, envisages

that if they fail to service the debt, the corporate in default undergoes

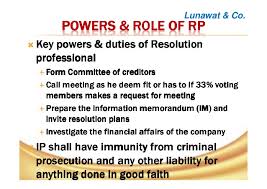

corporate insolvency resolution process (CIRP). An Insolvency Professional (IP)

carries on the business operations of the corporate as a going concern until

the Committee of Creditors (CoC) draws up a resolution plan that would keep the

business of the corporate going on for ever.

CORPORATE INSOLVENCY RESOLUTION PROCESS

(CIRP)

The Code, as stated in the long title, requires a CIRP to (a) maximise

value of assets of the corporate, and (b) while doing so, balance the interests

of all the stakeholders, and assigns this responsibility primarily to the IP,

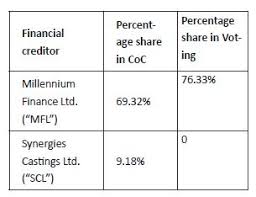

and the CoC comprising non-related financial creditors. The Code maximizes the

value by striking a balance between resolution and liquidation. It encourages

and facilitates resolution in most cases where creditors would receive at least

as much as they would in liquidation. This would happen where enterprise value

is ‘sufficiently’ higher than the liquidation value. In such cases, resolution

preserves and maximizes the enterprise value as a going concern. In the

remaining cases, the Code facilitates liquidation as that maximizes the value

for stakeholders.

RESOLUTION VS LIQUIDATION

The Code enables initiation of CIRP at the earliest, even at the very

first default, when enterprise value is usually higher than the liquidation

value and hence the CoC has the motivation to resolve insolvency of the

corporate rather than liquidate it. It mandates resolution in a time bound

manner to prevent decline in enterprise value with time, reducing motivation of

the CoC to opt for liquidation. It facilitates resolution; makes a cadre of

professionals available to run the corporate as a going concern; prohibits

suspension or termination of supply of essential services; enables raising

interim finances required for running the corporate; etc.

In contrast, the Code prohibits any action to foreclose, recover or enforce

any security interest during CIRP and thereby prevents a creditor(s) from

maximising his interests. It expects the creditors to recover their default

amounts collectively from future earnings of the corporate rather than from

sale of its assets.

PROWESS INTERNATIONAL PVT. LTD. VS.

PARKER HANNIFIN INDIA PVT. LTD

In the matter of Prowess International Pvt. Ltd. Vs. Parker Hannifin

India Pvt. Ltd., the NCLAT reiterated: “It is made clear that Insolvency

Resolution Process is not

a recovery proceeding to recover the dues of the creditors.” Further, the Code

enables a financial creditor to trigger CIRP even when the corporate has

defaulted to another creditor and thereby prevents any preferential treatment

to a creditor over others.

PARKER HANNIFIN INDIA PVT. LTD. VS.

PROWESS INTERNATIONAL PVT. LTD

In the matter of Parker Hannifin India Pvt. Ltd. Vs. Prowess

International Pvt. Ltd., the NCLT observed: “The nature of insolvency petition

changes to representative suit and the list does not remain only between a

creditor and the corporate debtor.” Resolution maximizes the value of assets of the corporate and

enables every stakeholder to continue with the corporate to share its fate. All

of them stand to gain or lose from resolution, while stakeholders in a category

receive similar treatment. In contrast, liquidation allows satisfaction of

their claims one after another. If there is any surplus after satisfying the

claims of one set of stakeholders fully, the claim of the next set of

stakeholders is considered.

THE ROLE OF CIRP

On both counts, maximization of value of assets and balancing the

interests, resolution triumphs over recovery as well as liquidation in most

cases. Balancing interests under CIRP assumes significance as every corporate

may not have enough resources at the commencement of CIRP to satisfy the claims

of all stakeholders fully, while resolution provides an opportunity to the CoC

to consider and balance their interests. In fact, the Code prescribes several

balances in resolution process: repayment of at least liquidation value to

operational creditors; repayment of interim finance in priority; approval of

resolution plan by 75% voting power; etc.

The CIRP regulations also provide for several balances. They allow a

dissenting financial creditor to exit at the liquidation value and thereby

protect its interests. Many creditors, however, may not like to exit at the

liquidation value. And those who exit, leave the enterprise value behind. This

balances the interests of financial creditors’ inter-se while tilting the

balance in favour of resolution.

A STATEMENT TO TAKE CARE OF THE

INTERESTS OF ALL STAKEHOLDERS

The regulations also require a resolution plan to include a statement

as to how it has dealt with the interests of all stakeholders, including

financial creditors and operational creditors, of the corporate debtor. The

judicial pronouncements require consideration of the interests of all

stakeholders in a resolution.

PROWESS INTERNATIONAL PVT. LTD. VS.

PARKER HANNIFIN INDIA PVT. LTD.,

In the matter of Prowess International Pvt. Ltd. vs. Parker Hannifin

India Pvt. Ltd., the NCLAT held: “In the circumstances, instead of interfering

with the impugned order, we remit the case to the Adjudicating Authority for

its satisfaction whether the interest of all stakeholders have been satisfied

...”

PRABODH KUMAR GUPTA VS. JAYPEE

INFRATECH LIMITED AND OTHERS

In the matter of Prabodh Kumar Gupta vs. Jaypee Infratech Limited and

others, the NCLT observed: “..the position of present petitioner is

undisputedly of stakeholders. Therefore, the IRP appointed by this Court in

respect of the corporate debtor company is equally expected to consider and

take care of the interests of the petitioner….”

Courtesy : IBBI Upadates July-September 2017

Courtesy : IBBI Upadates July-September 2017

No comments:

Post a Comment