WHETHER AN OPERATIONAL CREDITOR HAS THE RIGHT TO ASSIGN THE DEBT DUE

FROM A CORPORATE DEBTOR?

In

M/s. DF Deutsche Forfait AG and Anr. M/s. Uttam Galva Steels Limited:

FACTS OF THE CASE

M/s. Uttam Galva Steels Ltd. has been engaged in

manufacturing of steel rolls and import business in relation to steel. At some

time, the buyer had entered into a sales contract with AIC Handels GmBH (“AIC”

or “the seller”) for supply of prime steel billets.

The contract between

buyer and seller states that in case of any dispute, the arbitration shall be

pursued in accordance with Swiss Rules of International Arbitration of the

Swiss Chambers of Commerce.

Further, it was

decided that AIC is entitled to pursue payment obligation of the buyer

before any competent court where a specially abbreviated form of legal

procedure exists.

Upon the execution of

the shipment, Uttam Galva accepted the imports by the seller without any

faults and also confirmed that the amount set out in invoice represents

entire purchase price.

ASSIGNMENT OF THE DEBT BY AIC HANDELS GMBH

Subsequently, AIC

executed a discounting agreement with DF Deutsche For fait AG (“Deutsche”),

thereby assigning the entire debt owed to it by Uttam Galva Steels Ltd.

Deutsche, in turn,

subsequently assigned part of its debts to Misr Bank Europe GmBH (“Misr”)

through another discounting agreement.

A notification of the same was sent

by Deutsche to Uttam; however, was not confirmed by Uttam. This is the

precise reason that both Deutsche and Misr are the parties to the application.

CONTENTION BY UTTAM GALVA STEELS LTD.

CD argued that that

the definition of “dispute” is inclusive; mere denial to the claim shall be

understood as “dispute”.

UTTAM also argued that

the same bench member had rejected the application by the operational creditor

in the matter of M/s. Kirusa Software Pvt. Ltd v. M/s. Mobilox on the

ground that reply to the notice shows existence of dispute.

WHETHER THE OPERATIONAL CREDITOR HAS THE RIGHT TO ASSIGN THE DEBT

DUE FROM UTTAM?

The Tribunal was of

the opinion approval of the corporate

debtor is not sought for in case if there is a discounting agreement and mere

intimation bounds the corporate debtor to be liable towards the new

assignee.

WHETHER THE

APPLICATION CAN BE FILED UNDER THE INSOLVENCY AND BANKRUPTCY CODE, WHERE THE

CONTRACT PROVIDES FOR JURISDICTION FOR ENGLISH LAWS?

OC cited the provision

in the sales contract relating to the provision that AIC is entitled to pursue

payment obligation of the buyer before any competent court where a specially

abbreviated form of legal procedure exists.

However, the Bench declared that the corporate

debtors has been under disturbing situation as the corporate debtor is

consistently incurring into losses with amounts aggregating more than INR 15

billion. The bench is of the view that if any further delay is made in

accepting the application, it will become nothing but defeat the purpose and

object of the IBC Code.

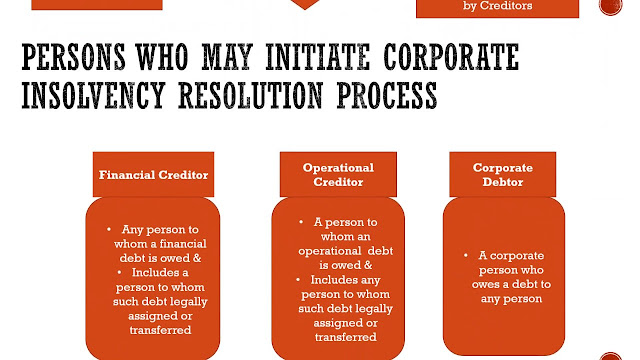

DECISION BY NATIONAL COMPANY LAW TRIBUNAL

The Bench held that

legal assignees are very much entitled to initiate CIRP action u/s 9. There

need not exist a separate contract between corporate debtor and the assignees

of corporate debtor to make their stand true to the fact under Indian Law.

Also, the bench felt of no need to have permission of corporate debtor granted

to assign the debts to the applicant’s viz. Deutsche and Misr in this case.

Hence, the applicants are eligible under Section 9 as Operational Creditors to

initiate insolvency action against M/s. Uttam Galva Steels Ltd.

No comments:

Post a Comment