INFORMATION UTILITY UNDER INSOLVENCY

& BANKRUPTCY CODE 2016

Last month, National

e-Governance Services Ltd (NeSL) became India’s first information utility (IU)

for bankruptcy cases under the Insolvency and Bankruptcy Code 2016. NeSL is

owned by State Bank of India and Life Insurance Corporation Ltd., among others.

Recently, the Insolvency and Bankruptcy Board of India (IBBI) eased ownership

norms for setting up such utilities.

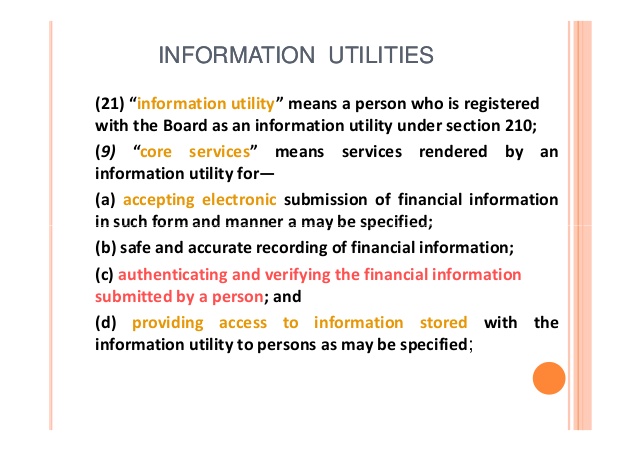

WHAT IS AN INFORMATION UTILITY?

Information utility is

an information network which would store financial data like borrowings,

default and security interests among others of firms. The utility would

specialise in procuring, maintaining and providing/supplying financial

information to businesses, financial institutions, adjudicating authority,

insolvency professionals and other relevant stake holders.

WHY IS IT

IMPORTANT? HOW USEFUL IS IT?

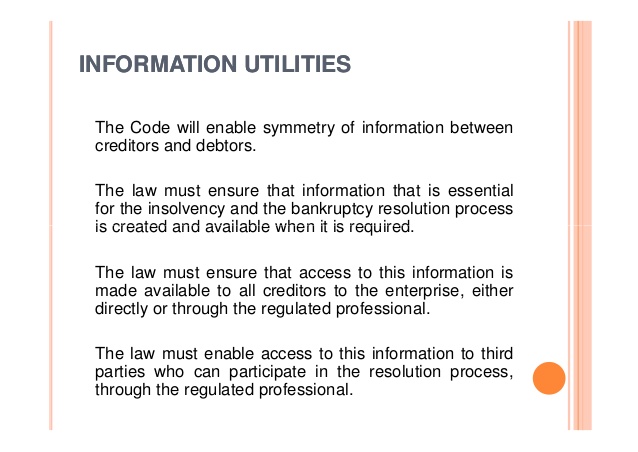

The objective behind

information utilities is to provide high-quality, authenticated information

about debts and defaults, as per the report of the Working Group on Information

Utility published by the Ministry of Corporate Affairs. Information utilities

are expected to play a key role as they allow storage of financial information

of registered users and expeditiously process and verify information received.

Moreover, the database and records maintained by them would help lenders in

taking informed decisions about credit transactions. It would also make debtors

cautious as credit information is available with the utility. More importantly,

information available with the utility can be used as evidence in bankruptcy cases

before the National Company Law Tribunal.

WHAT ARE THE

RULES GOVERNING THESE UTILITIES?

Information utilities

are governed by the Insolvency and Bankruptcy code 2016 and IBBI (Information

Utilities) Regulations 2017. The Insolvency and Bankruptcy Board of India

(IBBI) overseas aspects such as registration and cancellation of these

entities, their shareholding and governance among others. Recently, IBBI eased

norms for information utilities, allowing Indian firms listed on stock

exchanges to hold 100% in such firms. It also allowed individuals to hold 51%

in the utility for a period of three years

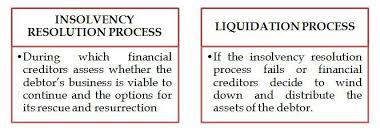

HOW WILL THE

UTILITIES HELP STAKEHOLDERS IN THE INSOLVENCY PROCESS?

MANDATORY FOR FINANCIAL CREDITORS

Financial creditors

(banks which provide loans to the company): It is mandatory for financial

creditors to provide financial information to the information utility. When

they initiate insolvency proceedings against the defaulting firm (known as

corporate debtor), the utilities may help as they would act as a centralised

platform for accessing data.

OPTIONAL FOR OPERATIONAL CREDITORS

Operational Creditor

(Suppliers of goods and services to the firm in question): Unlike financial

creditors, it is optional for the operational creditor to provide financial

information to the utility. While the idea behind information utility is to

have a financial data repository, it has to be seen to what extent firms

provide data with regard to dues owed to operational creditors and how the

utility is going to help the operational creditors during insolvency process.

WHAT ARE THE

KEY CHALLENGES FOR THESE UTILITIES?

While the onus is on

financial creditors, operational creditors and corporate debtors to provide the

required information, procuring authentic information might be a challenge due

to the sensitivity involved. There may also, be resistance in sharing

information. Since it is a digital database, there is the risk of exposure to

data piracy and data theft.

Courtesy: Mr. Sanjay

Vijayakumar, The Hindu

No comments:

Post a Comment