Moratorium under Section 14 is applicable also to Personal Guarantee given

by promoters under IBC Code 2016 says NCLAT , Mumbai Bench.

State Bank of India

vs

Ramakrishnan, Veesons

Energy Systems

Moratorium for Sale of Assets

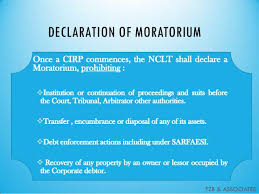

In a landmark judgment, the National Company Law Appellate Tribunal

(NCLAT) has ruled that personal assets of guarantors, who in most cases are

promoters, cannot be liquidated in companies facing corporate insolvency

resolution process under IBC. The moratorium on sale of assets applies not just

to corporate debtors but also personal guarantors under the Insolvency and

Bankruptcy Code (IBC), the tribunal said.

Mumbai NCLT in Schweitzer Systemtek India Case

NCLAT’s latest ruling has huge ramifications as

it offers relief for the personal assets of promoters. This also effectively

overturns another important ruling where the National Company Law Board’s

(NCLT’s) Mumbai bench held that the promoter cannot escape the liquidation of

personal assets by simply filing for bankruptcy. NCLT-Mumbai had ordered lenders

to go after the personal properties of Schweitzer Systemtek India in July 2017,

though the company brought voluntary bankruptcy proceedings.

Moratorium is also Applicable to employees, members, creditors, guarantors and other stakeholders

The NCLAT said, “From the IBC provisions, it is

clear that resolution plan, if approved by the committee of creditors and if

the same meets the requirements as referred to in sub-section (2) of Section 30

and once approved by the adjudicating authority, is not only binding on the

corporate debtor, but also on its employees, members, creditors, guarantors and

other stakeholders involved in the resolution plan, including the personal

guarantor.”

“In view of the provisions, we hold that the ‘moratorium’ (on sale

of assets) will not only be applicable to the property of the corporate debtor

but also on the personal guarantor,” the NCLAT ruled in an appeal filed by SBI

against V Ramakrishnan, a director in the Tiruchi-based Veesons Energy Systems

and who is the personal guarantor for the company.

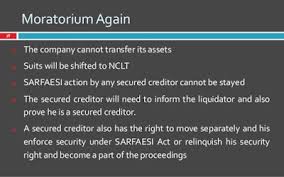

REMOVAL OF INCONSISTENCIES BY NCLAT

“The NCLAT has removed inconsistencies in

decisions of benches of NCLT. This also removes language deficiency in

Section 14 of IBC.” Section 14 of the IBC empowers the adjudicating authority

to declare a moratorium on the transfer, alienation or disposal of assets of the

corporate debtor.

SARFAESI (Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest) Act, 2002

SBI invoked its right under SARFAESI (Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest) Act, 2002 against the personal guarantor in August 2015 for recovery of Rs 61.1 crore.

The notice was challenged by the corporate debtor (Veesons Energy) in

the Madras high court, which was dismissed with costs in November 2016.

Following this, SBI issued a possession notice and took symbolic possession of

the secured assets. The personal guarantor filed an application in NCLT-Chennai

for stay of proceedings under the SARFAESI Act, 2002, including the auction

notice dated July 12, 2017.

No comments:

Post a Comment