Excess

Remuneration Taken By Resolution Personnel Is the Main Allegation against Deloitte

in Binani Cement Insolvency Case

RP to provide criteria for

selection of bidder, minutes of meetings by March 26, 2018

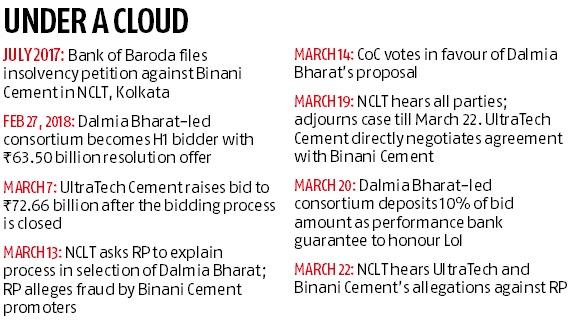

A single-member judge

in the Kolkata bench of the National Company Law Tribunal (NCLT) has

ordered the resolution professional for Binani Cement to submit by

March 26 the criteria and the procedure for selection of the bidder, minutes of

meetings, and a timeline of proposals and decisions taken after counsel

for Binani Cement and UltraTech Cement mounted their opposition to

the way the resolution plan had been concluded.

Opposition against Decision of Resolution Personnel

The plan approved by

resolution professional Vijay Kumar Iyer resulted in the Dalmia

Bharat Cement-led consortium winning the bid for Binani Cement. The judge

also sought details of the proceedings and outcome of the March 14 meeting when

the Committee of Creditors (CoC) approved the joint resolution plan of Dalmia

Bharat Cement and Bain Capital’s Resurgent India Fund.

Resolution

Personnel Has to Submit final progress report on the resolution plan

According to the

directive by Jinan K R, member judge at the Kolkata NCLT, Iyer will also have

to submit the final progress report on the resolution plan. Iyer has already

submitted the resolution plan approved by the CoC to the NCLT for

approval. Citing pending cases, the judge did not hear Binani Cement’s plea for

termination of insolvency proceedings. After obtaining a ‘comfort

letter’ from UltraTech Cement by agreeing to a 98.43 per cent stake sale by the

promoters for Rs 72.66 billion, Binani Cement had on March 19

informed the NCLT that it was seeking termination of insolvency proceedings

against it.

Lenders Allege Fraud

Meanwhile, the counsel

representing the lenders stated the alleged fraud by the company’s promoters as

claimed by Iyer will not impact the selling procedure and appealed to the judge

to consider the proposal if he finds it “proper”.

A series of questionable transactions

A source close to the

lenders said that when the bidders had placed their bids, they knew about a

series of questionable transactions and their bids had taken this factor into

consideration. The primary charge leveled against the Iyer by Binani

Cement is over the money spent in the resolution process.

Excessive Remuneration for Resolution Personnel

The counsel

representing the company alleged that excessive funds were spent by the

resolution professional in the process. Binani Cement has said apart from

a monthly remuneration of

Rs 3.5 million, insurance worth Rs 7.25 million was also claimed as expenses by

the resolution professional.

The company also

alleged that Rs 24 million

had been facilitated towards Deloitte India, the firm Iyer is associated with.

Defence by Deloitte

Iyer’s counsel

defended the claims, stating the resolution professional had to visit many

factories of Binani Cement where labour protests were occurring and

hence he needed insurance. The

judge pointed out there was no cap on remuneration or costs associated with the

resolution process. But

all expenses by the resolution professional will need the approval by the creditors.

Representative of Binani Cement was barred

According to sources

close to Binani Cement, the remuneration and other allowances of the resolution

professional should be on a par with employees of government-owned companies.

The Binani Cement counsel further alleged that despite an order of

the Delhi bench of the NCLT directing the resolution professional to

allow participation by a representative of Binani Cement, the person was not

allowed entry in meetings.

Contention of UltraTech Cement

The UltraTech Cement

counsel argued that no reason was provided to the firm why its bid was rejected

and the resolution professional did not provide an explanation. Moreover, it

wanted to know from the resolution professional that despite it revising its

bid to Rs 72.66 billion, higher than that made by Dalmia Bharat Cement, why its

offer was not considered.

Maximisation

of value is the ultimate goal of the NCLT

“Maximisation of value is the ultimate goal of

the NCLT and a time-bound process is just the procedure,” a source

close to UltraTech Cement said. The resolution process for Binani

Cement will end on April 21, after which no extension can be provided,

according to provisions of the Insolvency and Bankruptcy Code.

Out of a total of 14

applications in this case that were up for hearing on Thursday, only four were

heard in part and other applications, including one by State Bank of India Hong

Kong, one of the secured lenders that voted against the Dalmia Bharat-led

consortium’s proposal, have been put up for hearing on March 27.

Courtesy : Business

Standard

No comments:

Post a Comment