RECENT AMENDMENTS TO INSOLVENCY AND

BANKRUPTCY CODE 2016

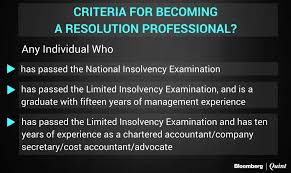

- · Now

, an Applicant has to pass the Limited Insolvency Examination within twelve

months before the date of his application for enrollment with the insolvency

professional agency;

- · He

has to complete a pre-registration educational course after his enrollment as a professional

member with IBBI.

- · He

has to disclose as to whether he was an employee of or has been in the panel of

any financial creditor of the corporate debtor

· .

An insolvency professional shall disclose the fee payable to him

GAZETTE OF

INDIA

EXTRAORDINARY

PART III,

SECTION 4

PUBLISHED BY

AUTHORITY

NEW DELHI, 27th

MARCH, 2018

INSOLVENCY AND BANKRUPTCY BOARD OF

INDIA

NOTIFICATION

New Delhi, 27th March, 2018

Insolvency and Bankruptcy Board of India (Insolvency

Professionals) (Amendment Regulations, 2018

IBBI/2017-18/GN/REG027

- In exercise of the powers conferred by sections 196, 207 and 208 read with

section 240 of the Insolvency and Bankruptcy Code, 2016 (31 of 2016), the Insolvency

and Bankruptcy Board of India hereby makes the following regulations to amend the

Insolvency and Bankruptcy Board of India (Insolvency Professionals)

Regulations, 2016, namely: -

1. (1) These regulations may be called the

Insolvency and Bankruptcy Board of India

(Insolvency Professionals) (Amendment) Regulations,

2018.

(2) They shall come into force on 1st

April, 2018.

2. In the Insolvency and Bankruptcy Board of India

(Insolvency Professionals)

Regulations, 2016 (hereinafter referred to as

principal regulations), in regulation 3, for sub-regulation (3), the following

sub-regulation shall be substituted, namely: -

“(3) The syllabus, format, qualifying marks and

frequency of the Limited Insolvency

Examination shall be published on the website of

the Board at least three

months before the examination.”.

3. In the principal regulations, for regulation 5,

the following regulation shall be substituted, namely: -

“5.

Qualifications and experience.-

Subject to the other provisions of these regulations,

an individual shall be eligible for registration, if he -

(a) Has passed the Limited Insolvency Examination within twelve months

before the date of his application for enrolment with the insolvency

professional agency;

(b) Has completed a pre-registration

educational course, as may be required by the Board, from an insolvency

professional agency after his enrolment as a professional member; and

(c)

has-

(i) successfully completed the National Insolvency

Programme, as may be approved by the Board;

(ii) successfully completed the Graduate Insolvency

Programme, as may approved by the Board;

(iii) fifteen years’ of experience in management,

after receiving a Bachelor’s degree from a university established or recognised

by law; or

(iv) ten years’ of experience as –

(a) chartered accountant registered as a member of

the Institute of Chartered Accountants of India,

(b) Company secretary registered as a member of the

Institute of Company

Provided that the insolvency professional entities

recognised as on the date of commencement of the Insolvency and Bankruptcy

Board of India (Insolvency Professionals) (Amendment) Regulations, 2018 shall

comply with the provisions of clauses (a), (b) (c) and (d) on or before 30th

September, 2018 and the provisions of clauses (e), (f) and (g) on or before

30th June, 2018.”.

6. In the principal regulations, in the First

Schedule, -

(i) for “[ Under regulation 7(2)(g)]” the following

shall be substituted, namely: - “[Under

regulationA 7 (2) (h)]”;

PRE-DISCLOSURE

REQUIREMENTS

(ii) after item (8), the following item shall be

inserted, namely: -

“8A. An insolvency professional shall disclose as to whether he was an

employee of or has been in the panel of any financial creditor of the corporate

debtor, to the committee of creditors and to the insolvency professional

agency of which he is a professional member and the agency shall publish such disclosure on its website.”;

(iii) after item (25), the following item shall be

inserted, namely: -

“25A. An insolvency professional shall disclose the fee payable

to him, the fee payable to the insolvency professional entity, and the

fee payable to professionals engaged by him to the insolvency professional

agency of which he is a professional member and the agency shall publish such

disclosure on its website.”.

7. In the principal regulations, in the Second

Schedule, for FORM A, the following Form A.

According to the amendment regulations,

a. Subject to meeting

other requirements, an individual shall be eligible for registration as an

insolvency professional if he has passed the Limited Insolvency Examination

within the last 12 months and has completed a pre-registration

educational course from an insolvency professional agency, as may be required

by the Board.

b. The syllabus,

format, qualifying marks and frequency of the ‘Limited Insolvency Examination’

shall be published on the website of the IBBI at least three months before the

examination.

c. An individual with

the required experience of 10 / 15 years is eligible for registration as an

insolvency professional. In addition, an individual with little or no experience

shall be eligible for registration as an insolvency professional on

successfully completing the Graduate Insolvency Programme, as may be approved

by the IBBI.

d. As a condition of

registration, an insolvency professional shall undergo continuing professional

education as may be required by the IBBI.

e. An insolvency

professional shall not outsource any of his duties and responsibilities under

the Code.

f. A company, a

registered partnership firm or a limited liability partnership shall be eligible

for recognition as an insolvency professional entity,

if –

i. its sole objective

is to provide support services to insolvency professionals, who are its

partners or directors, as the case may be;

ii. It has a net worth

of not less than one crore rupees;

iii. Majority of its

shares is held by insolvency professionals, who are its directors, in case it

is a company;

iv. Majority of

capital contribution is made by insolvency professionals, who are its partners,

in case it is a limited liability partnership firm or a registered partnership firm;