No changes in Insolvency and Bankruptcy Code till

September 2018.

Insolvency law

committee’s recommendations do not address all ambiguities in Code: Says

Central Government

THE

confusion and ambiguity in the Insolvency and Bankruptcy Code (IBC) will

continue for some more time, as the Central government is planning to wait for

two more quarters before proposing any changes in the code, as it seeks more

clarity on the issue.

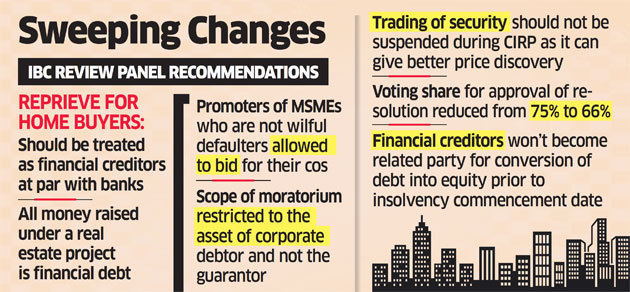

Recommendations of Insolvency Law Committee

The

government had formed a 14-member Insolvency Law Committee to give suggestions

on many ambiguous issues, including relaxing norms for MSMEs, ambiguity over

home buyers, and reforming the process of recovery.

The

committee had made various suggestions to the Ministry of Corporate Affairs.

However, the ministry now wants more time before making any changes in the

code.

“Many

recommendations have come and we are already evaluating them. However, the

recommendations alone will not be able to handle all ambiguity. So we will take

some more time before going for making a change. We will wait at least two more

quarters, till September 2018,” a senior official in the Ministry of Corporate

Affairs told The New Indian Express.

Another

reason the official gave is that the committee’s recommendations have not been able to address all the

ambiguities.

Whether Home Buyers have to be included as Financial

Creditors?

For

instance, the committee has recommended that homebuyers be treated as financial

creditors and argued that

non-inclusion of homebuyers in the definition of ‘financial’ or ‘operational’

creditors deprives them of the right to initiate the insolvency process.

However, real estate developers argue that treating homebuyers as financial

creditors would be in conflict with RERA regulations.

Whether 29A of IBC Code needs a Relook?

Another

point of ambiguity is Section 29A of the IBC code. The section says that any

person acting jointly or in concert with an ineligible person or related to the

ineligible person is barred from submitting a resolution plan. The committee

had pointed out that this clause would shrink the pool of resolution

applicants.

The

ministry, on the other hand, feels that relaxing the clause too much will

defeat the purpose of the law as many frauds are being conducted in collusion

with banks. It feels that relaxing the norms for creditors and bidders too much

would defeat the very purpose of creating the code.

MINISTRY’S VIEW

➊ 14-member

panel’s recommendations not conclusive, says ministry

➋ It will seek more opinions from the industry and policy experts

➌ Wants to wait till September end before implementing recommendations

➍ Points of ambiguity: Section 29, home-buyers and relaxed norms for creditors

➎ Government feels too relaxed norms for creditors will dilute the purpose of IBC

Courtesy: New Indian Express

No comments:

Post a Comment