IBBI

AMENDS REGULATIONS FOR INSOLVENCY RESOLUTION PROCESS

FAIR VALUE AND LIQUIDATION

VALUE

Insolvency resolution

professionals will now be required to assess the fair value and liquidation value of the entity

undergoing insolvency proceedings, with the latest set of amendments to the

regulations.

The Insolvency and

Bankruptcy Board of India (IBBI) has amended the norms pertaining to insolvency

resolution process for corporate persons.

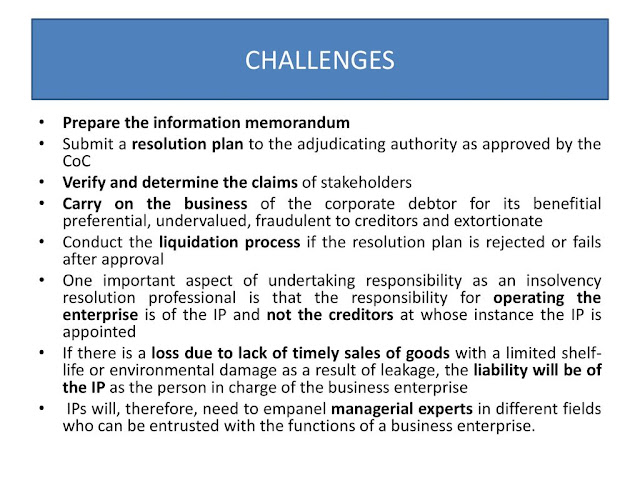

RESOLUTION PLAN

Under the revised

framework, the resolution plan -- approved by the committee of creditors -- should be submitted

to the adjudicating authority "at least 15 days before the expiry of the

maximum period permitted for the completion of the corporate insolvency

resolution process".

An official release

today said the norms have been amended wherein the resolution professional

should appoint two registered Valuers to determine the fair value and the

liquidation value of the corporate debtor.

COMMITTEE OF CREDITORS

"After the

receipt of resolution plans, the resolution professional shall provide the fair value and the

liquidation value to each member of the committee of creditors in

electronic form, on receiving a confidentiality undertaking," it said.

"It would help in

better price discovery for assets of corporate debtor in the process of

insolvency resolution,".

INFORMATION MEMORANDUM

According to the

release, the resolution professional should submit the information memorandum

in electronic form to each member of the committee of creditors within two

weeks of appointment.

Once an invitation,

including the evaluation matrix, is issued to a prospective resolution

applicant, the latter would have a minimum of 30 days to submit the resolution

plan.

The resolution

applicant would continue to specify the sources of funds that would be used to

pay insolvency resolution process costs, liquidation value due to operational

creditors and liquidation value due to dissenting financial creditors, the

release said.

However, the committee

of creditors would specify the amounts payable from resources under the

resolution plan for these purposes, it added.

"A resolution

plan shall provide for the measures, as may be necessary, for insolvency

resolution of the corporate debtor for maximisation of value of its assets.

"These may

include reduction in the amount payable to the creditors, extension of a

maturity date or a change in interest rate or other terms of a debt due from the

corporate debtor, change in portfolio of goods or services produced or rendered

by the corporate debtor and change in technology used by the corporate

debtor," the release said.

"As liquidation

value resulted in the estimated realizable value based on the piecemeal sale of

assets if the corporate debtor were to be liquidated on the insolvency

commencement date, it often resulted in a base value of the Assets of the

corporate debtor,"

The fair value is to

be arrived on going concern premise and is under a willing buyer willing seller

concept.

No comments:

Post a Comment