A FOREIGN FINANCIAL or operational CREDITOR CANNOT INVOKE INSOLVENCY

PROCEDURE IN INDIA IF HE DOES NOT PRODUCE A NO-DUE CERTIFICATE FROM INDIAN

FINANCIAL INSTITUTION – A MAJOR HANDICAP TO BE PLUGGED INTO.

Smart Timing Steel Ltd.

versus National Steel and Agro Industries Ltd

FACTS OF THE

CASE

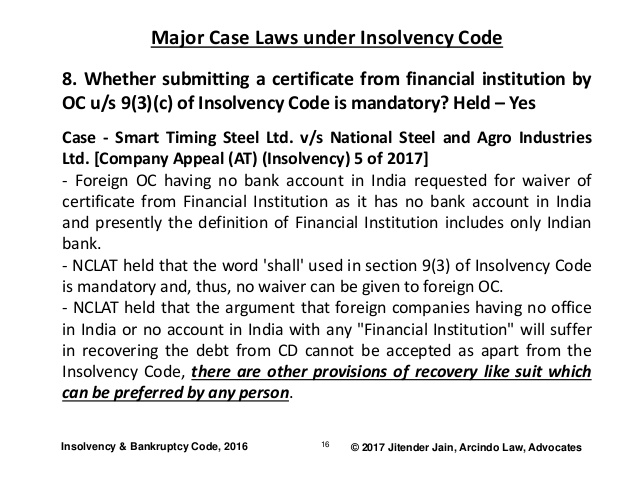

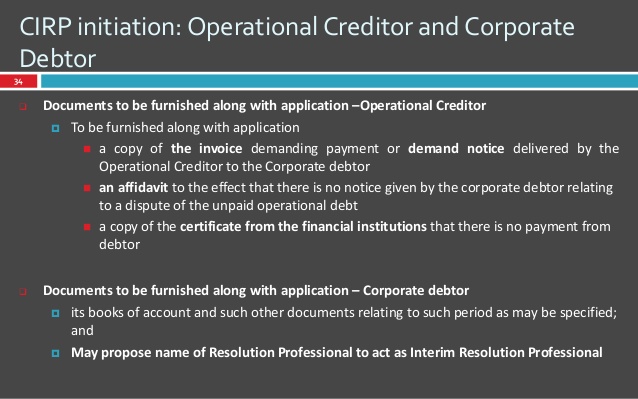

In this case, Smart Timing Steel Ltd. (“Appellant”),

being an Operational Creditor in this case, filed an application before the

Adjudicating Authority (Mumbai Bench) for initiation of corporate insolvency

resolution process under Section 9 of Insolvency & Bankruptcy Code (“Code”).

It is important to note that the Appellant did not submit the certificate

from the Financial Institution (maintaining its accounts) confirming that there

is no payment of the operational debt by the Corporate Debtor, along with

its petition, which is a mandatory requirement under Section 9 of the Code.

Later, when the

Appellant was given an opportunity to file the above certificate, it failed to

do so and submitted that it should be exempted from such compliance, as the

bank of the Appellant is situated outside India. The Appellant in this case had

no office or bank account in India with any of the scheduled banks, Financial

Institution (as defined under Section 45 of RBI Act, 1934), Public

Financial Institution (as defined under Section 2 (72) of the Companies Act,

2013) or with any other institution notified by Central Govt. as “

Financial Institution”. Consequently, the Appellant failed to enclose

such certificate from ‘Financial Institution’ maintaining its account.

DECISION OF

THE NCLAT , MUMBAI BENCH

The above petition of

the Appellant was rejected by the Adjudicating Authority on ground of

non-compliance with the provision of Section 9(3)(c) of the Code (i.e., non-filing

the above certificate). Aggrieved by the above order, the Appellant filed an

appeal before NCLAT under Section 61 of the Code).

DECISION OF

THE NCLAT

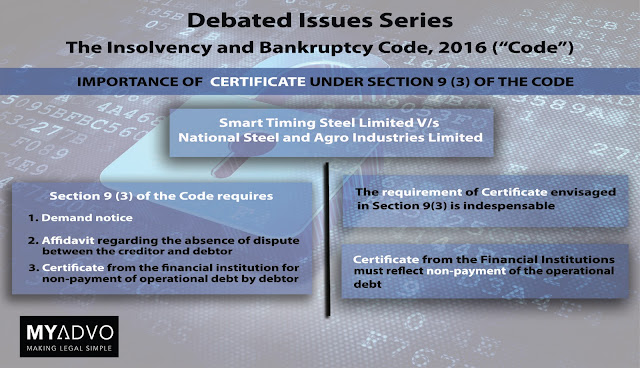

Referring to Section 9

of the Code, NCLAT observed that the entire provision of sub-clause (3) of

Section 9 is “required to be mandatorily followed and it is not empty

statutory formality”.

NCLAT was of the view

that the argument that foreign companies having no office in India or no

account in India with any Financial Institution will suffer in recovering the

debt from corporate debtor as it cannot be accepted as apart from the

Insolvency code, there are other provisions of recovery like suit which can be

preferred by any person.

Macquaire Bank

Limited V/s Uttam Galva Metallics Limited

In the above case also

, the same issue was raised . National Company Law Appellate Tribunal (NCLAT), Chandigarh, have

upheld the order of the Hon'ble NCLT Chandigarh wherein the Hon'ble Tribunal

had held that the "Certificate from a foreign Bank cannot be considered

as Certificate from financial institution as contemplated under Section 9 (3)

(c) of the I&B Code 2016."

However, the Supreme Court has over ruled the

NCLAT decision on 15th December, 2017 In the matter of Macquarie Bank Limited

Vs. Shilpi Cable Technologies Ltd. Civil Appeal no. 15135-2017 . Hence, Section 9(3)(c) is no longer mandatory but only directory in

nature.

The Supreme Court has over ruled the NCLAT decision

MY VIEWS

Indian Insolvency code

should not prescribe a procedure that cannot be satisfied or fulfilled against

foreign suppliers. Such provisions will be considered as ultra vires of UNCITRAL

Model Law on Cross-Border Insolvency (1997) to which Indian

government is a signatory or the provisions of free trade advocated by World Trade

Organisation to which Indian government is a signatory.

By making it mandatory the

certificate from an Indian financial institution , the foreign suppliers are put

at handicap. Declaring it as a mandatory provision for getting a certificate

from a Indian financial institution , it is submitted that it is against the

natural justice.

Instead , foreign

suppliers should be allowed to enclose the following along with their

application for initiation of insolvency under IBC Code 2016.

·

Copy of the contract entered between

Indian buyer and foreign supplier.

·

Copies of bill of lading and invoices.

· Copies

of the acknowledgement of receipt of goods

· Copy

of the notice served on Indian buyer demanding the payment.

· An affidavit by foreign supplier or his

power of attorney that no payment has been received from the Indian buyer.

This is a serious gap in the Insolvency and

Bankruptcy Code 2016 and this has to plugged immediately through suitable

amendment.

No comments:

Post a Comment