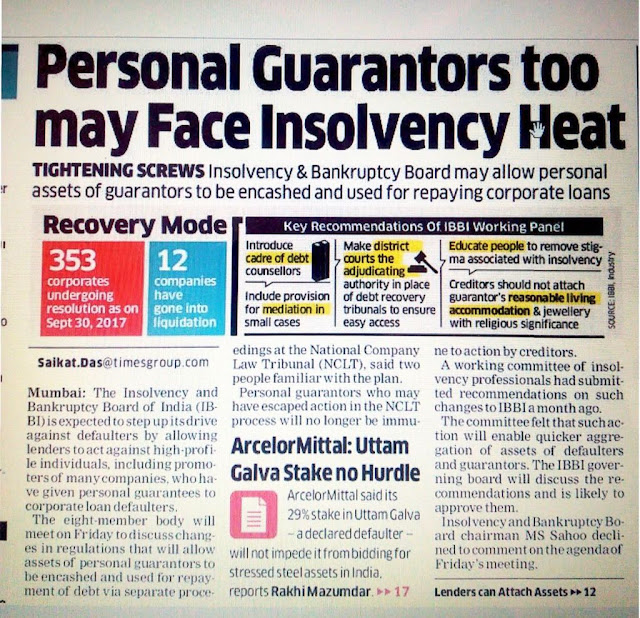

After Sureties, Promotors who have given

personal guarantee for the loans are to face heat Now-

Insolvency

& Bankruptcy board may employ personal assets of guarantors to be enchased

and employed for repayment of corporate loans.

MAJOR RECOMMENDATION OF IBBI WORKING PANEL

|

1

|

Introduction of a cadre of “Debt Counsellors”

|

|

2

|

Include provision of mediation in case of small

cases

|

|

3

|

To make the district courts as adjudicating

authority in place of debt recovery panel to ensure easy access.

|

|

4

|

To Educate People against the stigma associated with

insolvency

|

|

5

|

Creditors may be restrained from attaching the

living accommodation and jewellery of promotors with religious significance.

|

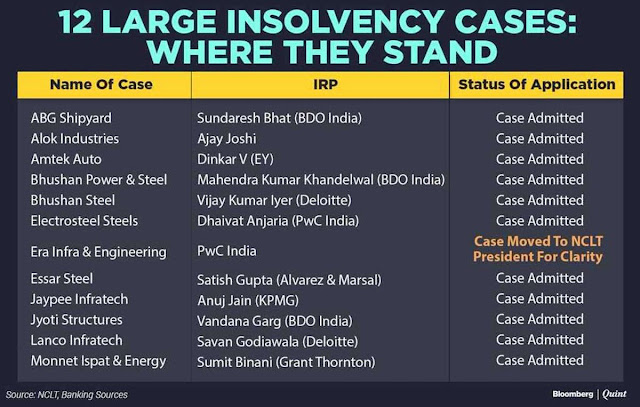

The

Present Status of Recovery Mode

|

1

|

353 Companies

in India are presently undergoing resolution process as of 30th

September 2017

|

|

2

|

12 Companies

have already gone into liquidation

|

The Insolvency and Bankruptcy Board (IBBI) is

seriously thinking to allow creditors of the company to encash the personal

guarantee given by the promotors of the Company in the process of their debt

realisation.

It is to be noted that personal guarantors who have

escaped action in the NCLT process will no longer be immune to recovery action

by creditors.

A working committee of Insolvency Professionals had

submitted recommendations on such changes to IBBI a month ago. The committee is

of the view that it will facilitate a quicker aggregation of assets of

defaulters and guarantors.

No comments:

Post a Comment