WHETHER

A DIRECTOR CAN BE ARRESTED UNDER SECTION 138 OF THE NEGOTIABLE INSTRUMENTS ACT,

1881 (NI ACT) WHEN A MORATORIUM ORDER WAS ISSUED UNDER IBC 2016?

CHEQUE

BOUNCING CASE

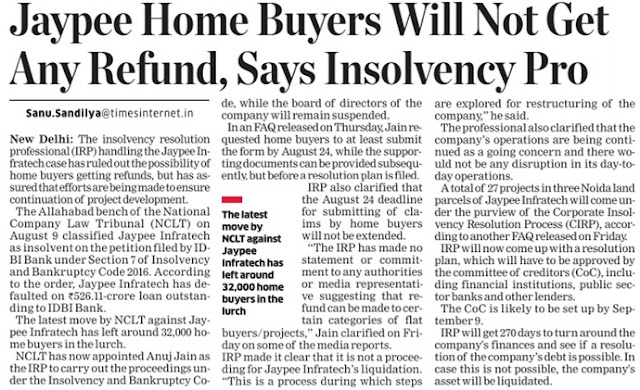

Recently, I received a call from one of the director of the

company. He informed me that his creditors have filed an insolvency proceedings

under IBC, 2016 and NCLT has approved their plan and initiated an insolvency

proceeding and declared a moratorium under section 14 of the Insolvency and

Bankruptcy Code, 2016.

He is receiving arrest threat from a police officer as an

action under section 138 of the Negotiable Instrument, 1881 which was ordered

by a court against him and other directors.

When he informed the police official that already a

moratorium has been issued under IBC 2016 and hence, proceedings under section

138 of the Negotiable Instrument, 1881 is to be kept pending till the

insolvency proceedings are over.

However, the police official is not accepting the same and he

is threatening to initiate action under the Negotiable Instrument, 1881.

Is the Police official is right or does not aware the recent

development under IBC 2016. This issue is faced by many directors of the

various companies in India who have bounced their cheques and is undergoing the

process of Insolvency proceedings.

WHAT IS MORATORIUM ORDER UNDER SECTION 14 OF THE INSOLVENCY AND

BANKRUPTCY CODE, 2016?

Moratorium order under section 14 of the

Insolvency and Bankruptcy Code, 2016

|

It refers to a period when no judicial

proceedings for recovery, enforcement of security interest, sale or transfer

of assets, or termination of essential contracts can be instituted or

continued against the corporate debtor or its director

|

|

|

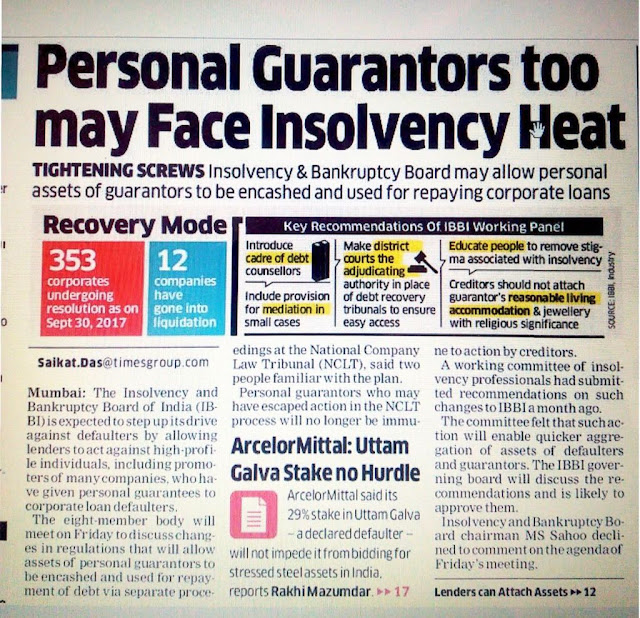

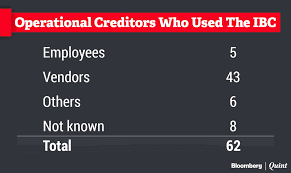

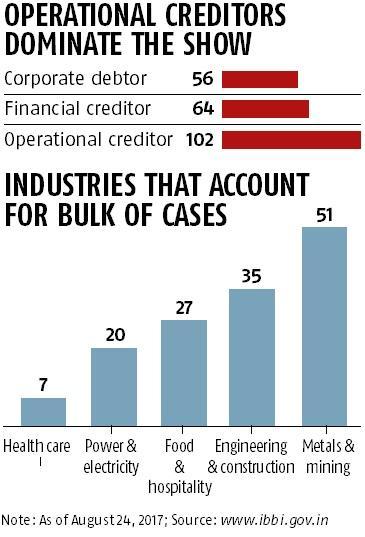

WHO CAN CLAIM AN ACTION UNDER IBC 2016?

If a creditor claim is Rs 100,000 or more and

the corporate debtor is unable to pay

|

A petition for insolvency against a corporate

debtor can be triggered by a financial creditor, an operational creditor or

by the corporate debtor itself.

|

WHAT IS MEANT BY CORPORATE INSOLVENCY RESOLUTION

PROCESS? (CIRP)

CIRP

|

It is time bound and the relief of moratorium

is available to the corporate debtor

|

|

|

|

Insolvency process is to be completed within

|

CIRP-

Normal Process

|

180 days

|

Plus maximum 90 days

|

270 days

|

CIRP-Fast

Track Process

|

90 days

|

45 days (one time)

|

135 days

|

WHAT SECTION 14 OF IBC CODE SAYS ABOUT MORATORIUM?

14. (1) Subject to provisions

of sub-sections (2) and (3), on the insolvency

commencement date, the Adjudicating Authority

shall by order declare moratorium for prohibiting all of the following,

namely:—

(a) the institution of suits

or continuation of pending suits or proceedings against the corporate debtor

including execution of any judgment, decree or order in any court of law,

tribunal, arbitration panel or other authority;

When section 14 of IBC code clearly states

that no proceeding against any corporate debtor can be taken due to any judgment, decree or order in

any court of law, tribunal, arbitration panel or other authority, how an

arrest under section 138 of the Negotiable instrument Act can be

initiated. This is the main question

still to be clarified.

STRICT CALM PERIOD

The IBC offers that after the initiation of

insolvency proceedings for revival of the corporate debtor, there should

prevail a stern calm period and complete moratorium in all cases where the

primary liability is that of the corporate debtor.

Thus, even proceedings against the guarantors

or the directors of the corporate debtor should be stayed until the committee

of creditors delivers its verdict on whether revival of the corporate debtor is

possible or not.

WHETHER

MORATORIUM COVERS DIRECTORS WHO HAVE BEEN FOUND GUILD UNDER SECTION 138 OF THE

NI ACT?

In the insolvency proceedings, the major

accountability is that of the corporate debtor and when there is a stay of

proceedings (moratorium) against the corporate debtor, it will mechanically end

in transferring the chief liability to the director of the corporate debtor.

This ultimately will result in the opening of

floodgates and will mean that the creditors will chase the directors during

what is supposed to be a period of calm. The intent to provide a calm period

during which the focus of the creditors is on revival of the corporate debtor

will result in a futile exercise.

ULTRATECH

ENGINEERING LIMITED CASE

In the above case, NCLT,

Mumbai held that an order of Moratorium issued under IBC Code supersedes

any other Act in force. That means no action can be initiated against directors

of company under insolvency for an offence under section 138 of the NI.

Whether Insolvency and Bankruptcy Code, 2016 (Code) supersedes any

State Law ?

Held yes by Mumbai NCLT in ICICI Bank Ltd vs. Innoventive Industries

Ltd.

CONCLUSION

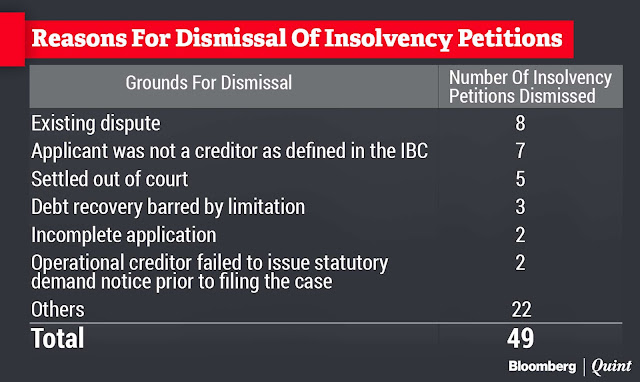

It may be concluded

that the IBC has not defined what acts will preclude if moratorium order is

issued, and whether the proceedings under the ambit of section 14 of the IBC

can be enacted against a corporate debtor or its director or not.

However, the

morphological of section 14 is extensive and the purpose of the legislature was

to offer a period of complete calm period to a corporate debtor under

CIRP.

Suitable circular or

clarification should be issued under IBC 2016 so that the directors who have

defaulted payment and has been indicted under section 138 of NI Act are

safeguarded until the moratorium period under IBC 2016.