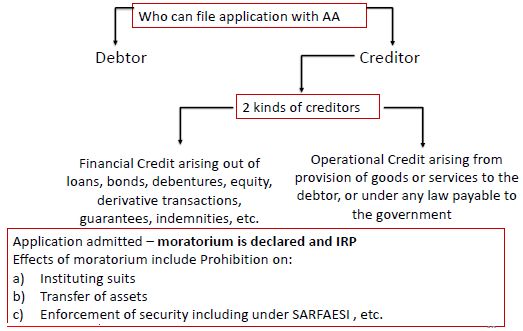

A FINANCIAL CREDITOR CANNOT INITIATE ACTION

UNDER SARFAESI Act, 2002 WHEN A MOROTORIUM WAS ISSUED AGAINST A CORPORATE

GUARANTOR UNDER SECTION 14 OF IBC Code 2016.

NATIONAL COMPANY LAW APPELLATE TRIBUNAL, CHENNAI HELD IN

STATE BANK OF INDIA

Vs.

M/s. VEESONS ENERGY SYSTEMS PVT. LTD

FACTS OF THE CASE

Mr. V. Ramakrishnan

(1st Respondent), Director of M/s. Veesons Energy Systems Pvt. Ltd. (“Corporate

Debtor”) given personal guarantee and mortgagor of collateral securities of his

assets with the Appellant State Bank of India (“Financial Creditor”) against

the facilities availed by the ‘Corporate Debtor’. In view of the personal

Guarantee given by Mr. V. Ramakrishnan (1st Respondent), he comes within the

meaning of ‘Personal Guarantor’ as defined under sub-section (22) of Section 5

of the Insolvency and Bankruptcy Code, 2016 (hereinafter referred to as

“I&B Code”).

ACTION

AGAINST PERSONAL GUARANTOR BY

STATE BANK OF INDIA- FINANCIAL CREDITOR

The State Bank of India (“Financial Creditor”)

invoked its right under Securitisation and Reconstruction of Financial Assets

and Enforcement of Security Interest Act, 2002, (hereinafter referred to as

“SARFAESI Act, 2002”) against the ‘Personal Guarantor’ under Section 13(2) on

4th August, 2015 for recovery of Rs. 61,13,28,785.48/- from the said 1st

Respondent as securities. The notice was challenged by the ‘Corporate Debtor’

before the Hon’ble High Court of Madras, which was dismissed with costs on 17th

November, 2016. Thereafter, the State Bank of India (‘Financial Creditor’)

issued a Possession Notice dated 18th November, 2016 under Section 13(4) of the

SARFAESI Act, 2002 and taken symbolic possession of the secured assets.

INITIATION OF CIRP UNDDER SECTION 10 OF THE ‘

I&B CODE’ 2O16

BY CORPORATE DEBTOR.

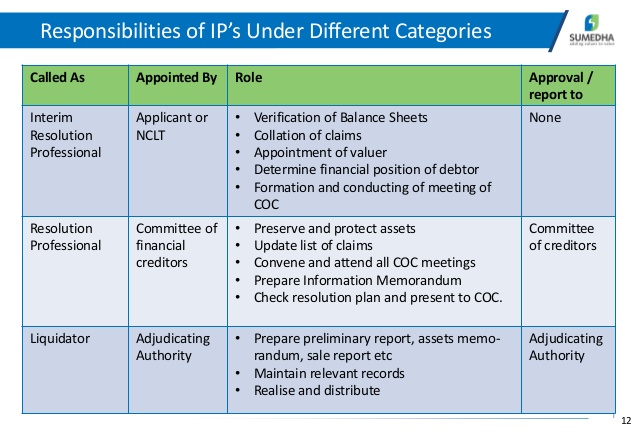

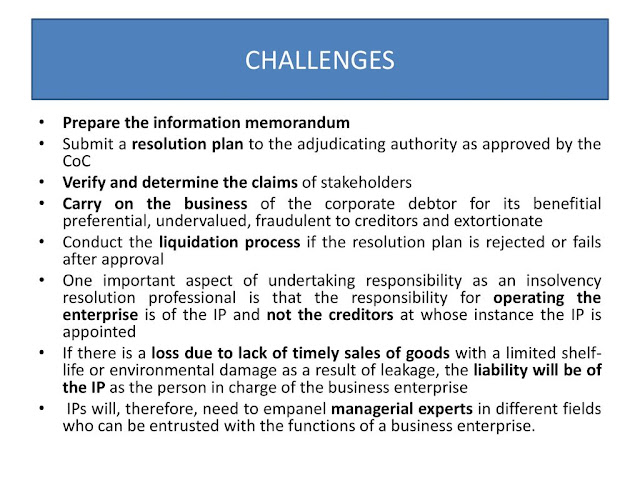

Having failed to get

relief from Hon’ble High Court of Madras, the ‘Corporate Debtor’ invoked

Section 10 of the ‘I&B Code’ which was admitted, order of ‘Moratorium’ was

passed and an ‘Interim Resolution Professional’ was appointed. 4. Even after

declaration of the ‘Moratorium’, the Appellant- State Bank of India (‘Financial

Creditor’) continued to take measure under SARFAESI Act, 2002 and proceeded

against the property of the ‘Personal Guarantor’ (1st Respondent) and issued

Sale Notice on 12th July, 2017.

SECTION 140 OF THE INDIAN CONTRACT ACT

In view of the

provisions of ‘I&B Code’, Section 140 of the Indian Contract Act, 1872 and

the decision of the Hon’ble High Court of Madras, the Adjudicating Authority

allowed the Interlocutory Application preferred by the ‘Personal Guarantor’,

and restrained the Appellant- State Bank of India (‘Financial Creditor’) from

proceeding against the ‘Personal Guarantor’ till the period of ‘Moratorium’ is

over.

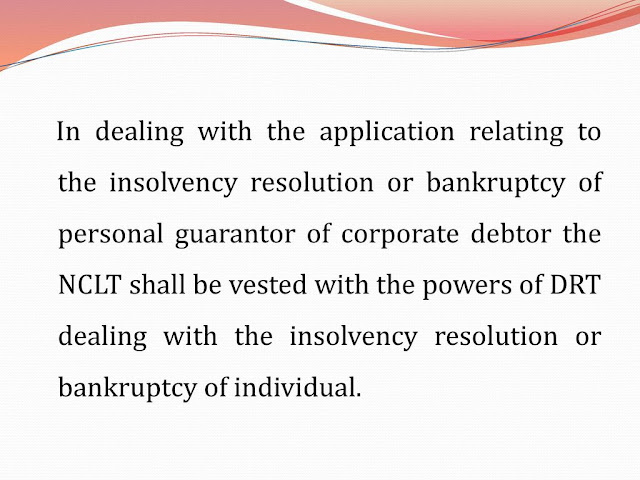

WHETHER MORATORIUM IS APPLICABLE TO

PERSONAL GUARANTEE?

Learned counsel for

the Appellant submits that the order of ‘Moratorium’ will not affect the assets

of the ‘Personal Guarantor’. On the other hand, according to counsel for the

Respondents, in view of subsection (1)(b) of Section 14 and sub-section (1) of

Section 31 of the ‘I&B Code’, the Appellant- State Bank of India

(‘Financial Creditor’) cannot proceed even against the ‘Personal Guarantor’.

DECISION

NCLAT held that on

bare perusal of the aforesaid provisions, it is clear that not only institution

of suits or continuation of pending suits or proceedings against the ‘Corporate

Debtor’ are prohibited from proceedings, in terms of clause (b) of sub-section

(1) of Section 14 of the ‘I&B Code’, transfer, encumbrance, alienation or

disposal of any of its assets of the ‘Corporate Debtor’ and/ or any legal right

or beneficial interest therein are prohibited. Clauses (c) & (d) of

sub-section (1) of Section 14 of the ‘I&B Code’ prohibits recovery or

enforcement of any security interest created by the corporate debtor in respect

of its property including the property occupied by it or in the possession of

the ‘Corporate Debtor.

APPLICABILITY OF MORATORIUM TO GUARANTOR

In view of the

aforesaid provisions, NCLAT , Chennai that the ‘Moratorium’ will not only be

applicable to the property of the ‘Corporate Debtor’ but also on the ‘Personal

Guarantor’.